Xerox had proposed a $22-a-share (£16.97) takeover deal, of which $17 would be in cash, for the much larger HP business earlier this month. The total deal value was approximately $33.5bn and HP shareholders would own 48% of the combined entity.

Yesterday (17 November), HP’s board sent a letter to Xerox CEO John Visentin rejecting the “unsolicited proposal”, which was described as “highly conditional and uncertain” in nature “including the potential impact of outsized debt levels on the combined company’s stock”.

However, the letter did not rule out the possibility of a revised deal, but said that HP had fundamental questions that would require detailed due diligence.

It stated: “We recognise the potential benefits of consolidation, and we are open to exploring whether there is value to be created for HP shareholders through a potential combination with Xerox.

“However, as we have previously shared in connection with our prior requests for diligence, we have fundamental questions that need to be addressed in our diligence of Xerox. We note the decline of Xerox’s revenue from $10.2 billion to $9.2 billion (on a trailing 12-month basis) since June 2018, which raises significant questions for us regarding the trajectory of your business and future prospects.

“In addition, we believe it is critical to engage in a rigorous analysis of the achievable synergies from a potential combination. With substantive engagement from Xerox management and access to diligence information on Xerox, we believe that we can quickly evaluate the merits of a potential transaction.”

The letter concluded: “We remain ready to engage with you to better understand your business and any value to be created from a combination.”

Activist Xerox investor Carl Icahn has reportedly spent $1.2bn on a 4.24% stake in HP. Icahn is yet to comment publicly about the Xerox proposal or the latest turn of events.

In Xerox’s 5 November letter to the HP board outlining the perceived benefits of the deal, Visentin cited opportunities in a number of print markets.

He said: “Our board of directors strongly believes the industry is overdue for consolidation and that those who move first will have a distinct advantage in a secularly declining macro environment.

“By combining R&D capabilities and financial resources, together we can accelerate the transformation of our businesses and take a leadership role in key growth markets such as: 3D Printing, Digital Packaging and Labels, Graphics, Textile Printing, Workflow Software and IoT Enabled Services.”

Xerox had not commented on HP’s rejection letter at the time of writing.

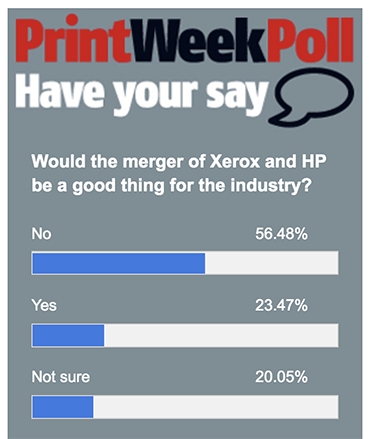

A Printweek poll on the subject has gained in excess of 400 votes, with more than 56% of respondents believing that merging the two companies would not be a good thing for the printing industry.