Under EPR rules, packaging converters, producers and suppliers will be forced to take responsibility for the packaging they produce or commission by paying fees based on how difficult the packaging is to dispose of responsibly.

Currently, the legislation has been put back to 2025 after an initial scheduled roll-out date of October 2024, which was put back in July 2023.

Companies involved in packaging will still have to collect and process data on the amount and nature of packaging they use or produce during the delay.

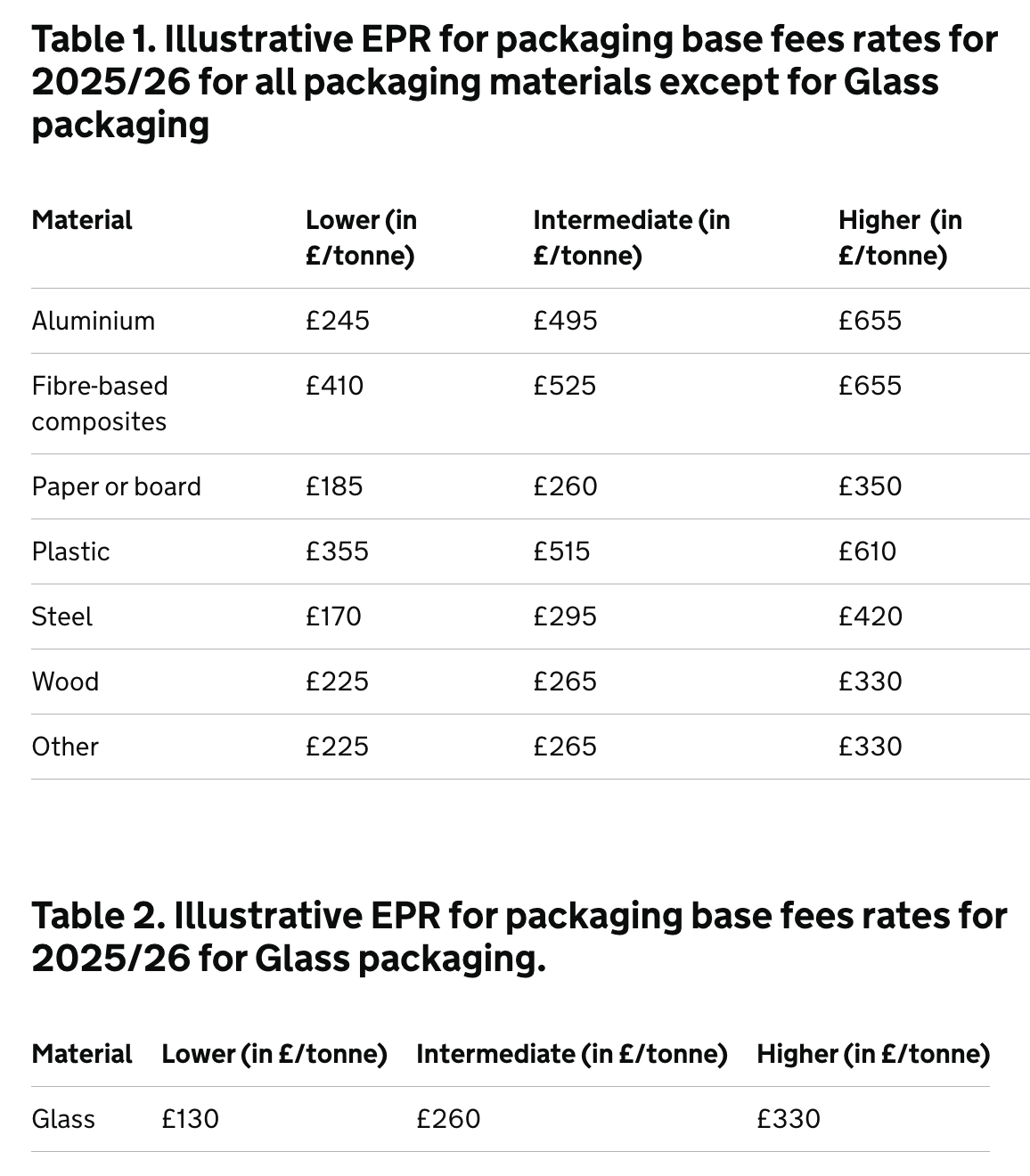

The new pricing estimates, released on 15 August, will apply to fees incurred on 1 April each year, based on the packaging supplied by registered producers for the preceding calendar year.

The base fees have been calculated using the weights of household packaging on the market in 2022 – though the government stressed that they are not the final fees, and said that producers may want to use higher and lower estimates to assess best and worst-case scenarios.

Paper and board enjoyed some of the cheapest estimated fees, with estimates ranging from £185-£350 per tonne.

Compared to fibre-based composites’ estimates of £410-655/tonne, and plastics’ £355-£610/tonne estimates, paper and board look to be a relative bargain – though steel’s low-end estimate of £170/tonne was the lowest estimate of all.

And while aluminium’s top-range estimate was the joint most expensive at £655, its lower estimate was far lower at £245/tonne – giving producers significantly varying final estimated cost impacts on their business.

Jacob Hayler, executive director of waste and recycling body The Environmental Services Association, said the new advice was reassuring for packaging producers, and provided “much-needed clarity” for investors in the circular economy over the incoming legislation.

“The announcement also provides much-needed clarity to obligated packaging producers to enable them to prepare for the introduction of charging from 2025 – helping to build a more complete picture of the economics of the new regime,” he said.

“The Resources and Waste Strategy reforms remain essential to delivering progress against binding national recycling targets; to reducing waste; and to delivering green growth – so visible policy progress after a prolonged period of stagnation and uncertainty will undoubtedly boost confidence among the organisations and investors responsible for delivering these outcomes.”

Not everyone was so pleased to see the guidance, however, with the CEO of the British Beer and Pub Association, Emma McClarkin, criticising “eye-watering” additional costs for producers.

She said: “While these estimated fees provide long-overdue clarity, they sharply reinforce our concerns about the eye-watering additional costs brewers will be expected to bear from next year and impact on customers.

“These preliminary figures could add up to 7p on each of the 3.2 billion bottles of beer sold in the UK annually, which would mean up to £212m in total. This could be the equivalent of a 21% beer duty increase on these products and inevitably will lead to price increases for consumers.”

Nick Kirk, technical director at British Glass, was also hesitant in his praise, encouraging the government to implement a ‘cost per unit’ system, rather than calculating the fees based on material weight.

He said: “We urge the government and stakeholders to reconsider the fee structure of the EPR scheme in advance of the second set of illustrative base fees due to be published in September. Adopting a cost per-unit system will drive better environmental outcomes, as individual units of packaging impact the environment rather than the weight of packaging.

“Defra must avoid market distortion through EPR and develop a more equitable and competitive market for all packaging materials.”

The figures are still subject to significant uncertainty and will change in future.

Government intends to publish refined figures for the illustrative base fees in September 2024, once the data received via its RPD online portal has been “further reviewed and evaluated”. The illustrative fees are also subject to the 2024 spending review.